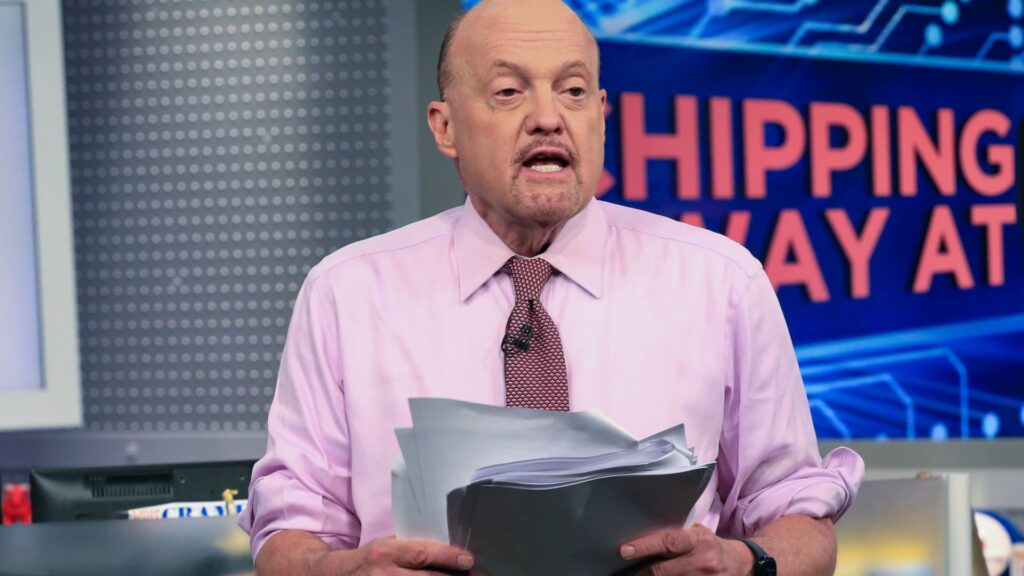

CNBC’s Jim Cramer said it sometimes seems like the Federal Reserve is “all-powerful.” However, while the central bank can make conditions better or worse, it can’t control everything, he continued.

At the end of the day, he said, “we still have a market economy, and markets are inherently boom and bust creatures.”

“The action in the stock market doesn’t always sync up perfectly with the real world, but various sectors come in and out of fashion based on the real-world health of the economy,” he said. “You need to know how to take the economy’s temperature, and looking at the unemployment rate or listening to pundits —even me — doesn’t really cut it.”

When the economy seems to be doing well and employment data is positive, Cramer said investors should keep an eye on certain groups of stocks that can signal a slowdown. Some sectors are more economically sensitive than others, he said, or they are more likely to see losses early on in a downturn.

If stocks related to housing and automobiles start to perform poorly, it might be a sign that the economy is about to peak — or at least investors are betting on a peak — Cramer said. Economic growth can cause long-term rates to rise, he continued, which makes it more expensive for consumers to take out housing or car loans.

Commodity companies, such as those that make paper or chemicals, may also get hit at the start of an economic downturn, Cramer said. Paper companies can be a good barometer of global commerce, he continued, as less paper means less packaging. Plastic is ubiquitous, Cramer added, so it’s “a real good tell.” According to him, copper is also economically sensitive and connected to the global economy.

“So, watch the homebuilders, watch the automakers, watch the paper stocks, and particularly, watch the price of copper,” he said. “That way, you won’t feel clueless the next time something goes wrong, and you’ll have a much better idea of what to do with your stocks.”