When making critical decisions about investments, company acquisitions, or capital deployment, organizations rely on a fundamental tool: the hurdle rate. This is the minimum rate of return that a project or investment must achieve to be considered viable by managers or investors.

The hurdle rate is not just a number — it’s a filter that separates promising opportunities from those that don’t justify the risk.

It acts as a crucial benchmark. If the expected return on an investment falls below the hurdle rate, that opportunity is typically rejected.

Setting this rate involves a careful consideration of several factors, including the company’s cost of capital, specific risk profile, inflation rates, and opportunity cost of allocating resources elsewhere.

In essence, the hurdle rate ensures that only projects with the potential to create real value move forward.

Bitcoin has emerged as a disruptive and compelling candidate for a new kind of hurdle rate in capital allocation. Its unique properties challenge the conventions of traditional finance and invite a new thought pattern of what’s considered an appropriate benchmark.

Bitcoin’s fixed supply (capped at 21 million), and its decentralized, borderless nature makes it fundamentally resistant to inflation and debasement, unlike fiat currencies that can be printed at will by central banks.

Here’s the real question for investors and fund managers: if your portfolio or fund consistently fails to outperform bitcoin, at what point do you simply start allocating to bitcoin instead?

This isn’t rocket science. Over the past decade, bitcoin has not only outperformed traditional assets, but has also redefined what investors should expect as a minimum acceptable rate.

The numbers speak for themselves.

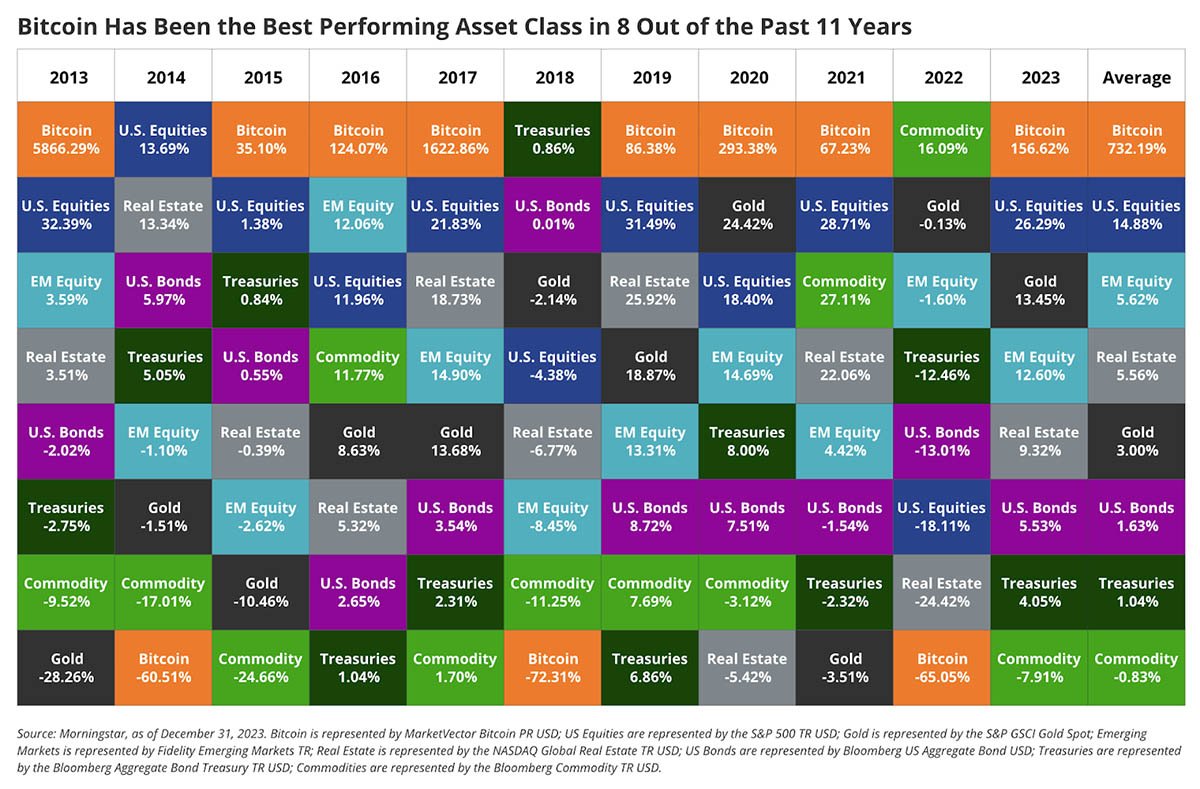

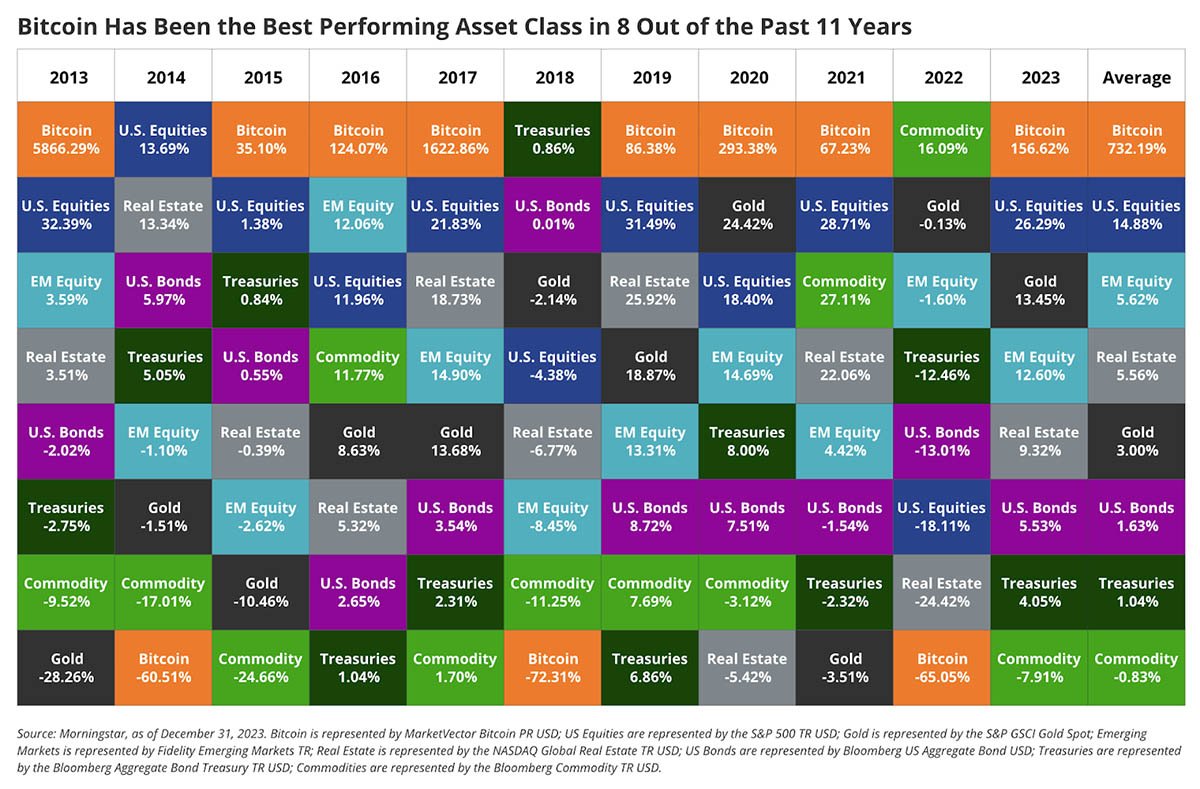

From 2013-2023, bitcoin delivered the highest annual return in 8 out of those 11 years. This is not a fluke or a bubble, it’s a decade-long trend that demands attention from anyone serious about capital growth.

Typically, most investment managers use the S&P 500 as their benchmark hurdle rate. Will their potential investment generate more return than the S&P? If not, it’s usually dismissed.

Since 1970, the S&P 500 has provided an average annual return of 10.66%. Investment managers routinely reject ideas that can’t beat this average, recognizing that anything less is not worth the risk or effort.

But what happens when we compare this to bitcoin?

Over the last 10 years, bitcoin’s average annual return has been an astonishing 49%. While it’s unlikely that this rate will persist forever, it’s impossible to ignore the magnitude and consistency of bitcoin’s outperformance.

Bitcoin hasn’t just beat the S&P—it’s outperformed every major asset class, including gold, treasuries, real estate, commodities, and equities.

Of course, past performance isn’t a guarantee of future results. So the question becomes: can bitcoin continue to deliver, and are we ready to use it as a benchmark for investment decisions?

To answer this, it’s essential to understand the underlying forces driving bitcoin’s price appreciation.

Several macroeconomic factors contribute to bitcoin’s rise, including money printing, economic uncertainty, and the ongoing debasement of fiat currencies.

When governments print money or run deficits, confidence in traditional currencies erodes. In such environments, investors naturally seek scarce assets, historically gold, and now increasingly bitcoin.

Consider the current fiscal reality: the United States is burdened with over $36 trillion in national debt, and there’s little indication that the money printing will stop.

This environment only strengthens the case for bitcoin as a store of value and as a benchmark for capital allocation. Bitcoin’s staying power is becoming undeniable.

Those who fail to adapt, risk being left behind. We’re already witnessing the early stages of institutional and corporate adoption, and it’s only a matter of time before bitcoin becomes a standard reference point for hurdle rates across the investment world.

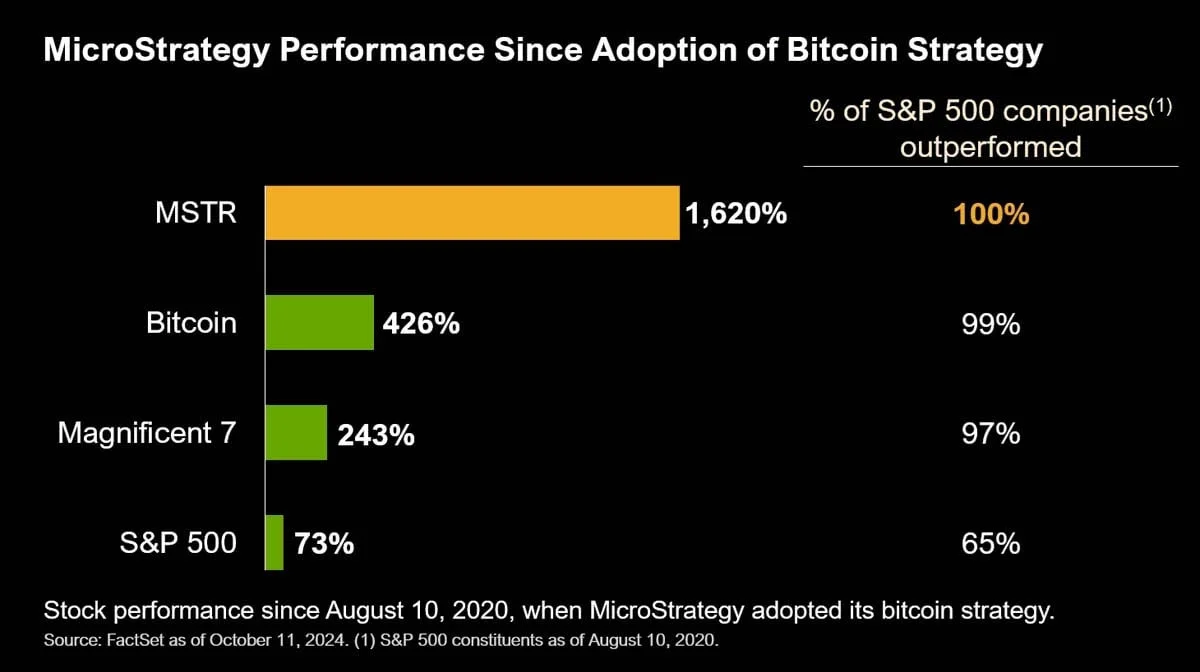

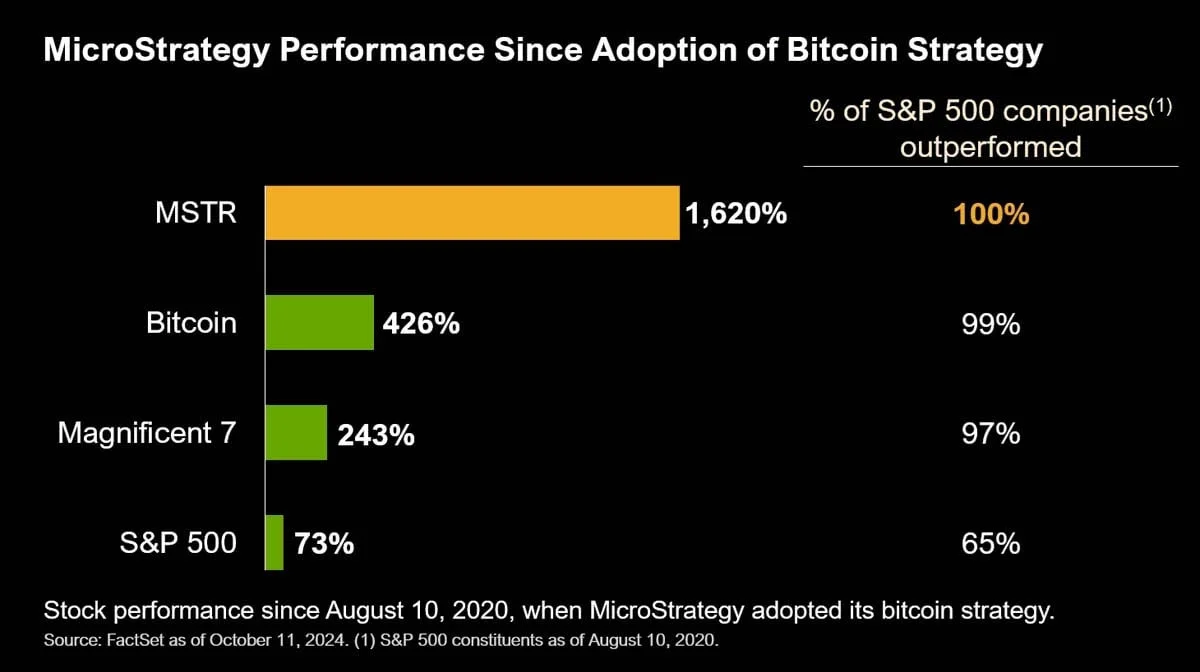

Visionary leaders like Michael Saylor of Strategy, have openly discussed the challenges of outperforming the world’s top companies.

Saylor recognized that if your investment, company, or project cannot reasonably be expected to outperform bitcoin, it may be more rational to simply hold bitcoin itself.

In a world where bitcoin has established itself as the premier performing asset, the message is clear: if you can’t beat bitcoin, why not join it?

Just buy bitcoin.