ARK Invest has just taken the wraps off its latest-and-greatest bitcoin price prediction for 2030, and that forecast is a real doozy.

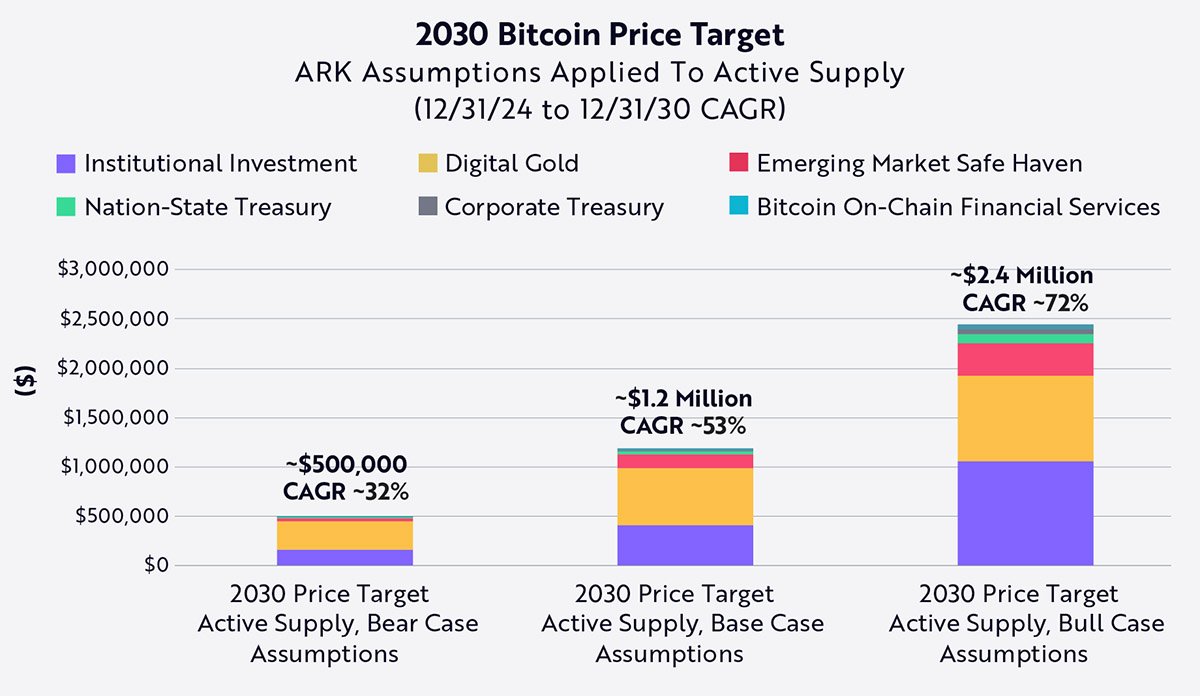

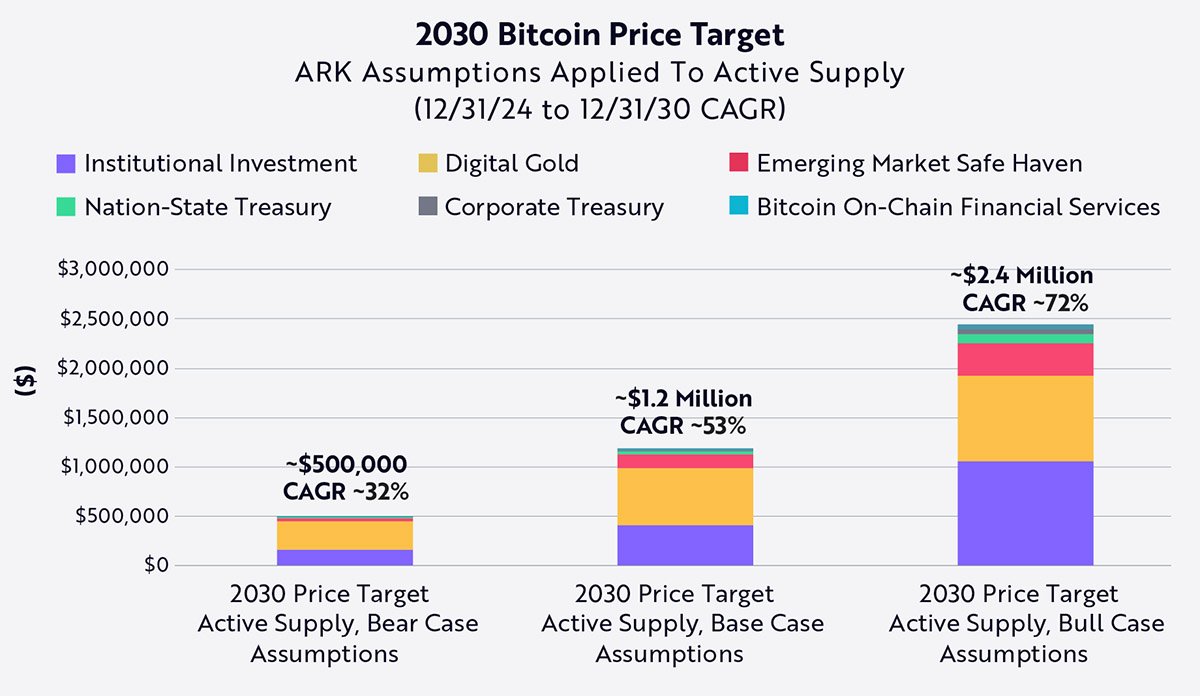

The investment firm led by Cathie Wood now predicts bitcoin could hit $2.4 million in a best-case scenario—that’s up from its previous estimate of $1.5 million.

That updated outlook also includes a base case of $1.2 million and a bear case of $500,000 by the end of the decade.

Those forecasts are part of ARK’s Big Ideas 2025 study—and they reflect growing optimism about Bitcoin’s future.

“Institutional investment contributes the most to our bull case,” says David Puell, a research analyst at ARK.

He explained the numbers are based on bitcoin taking a larger share of the $200 trillion global financial market, excluding gold.

Several key factors are fueling ARK’s aggressive price targets. The first factor considers institutional adoption to be the biggest driver of the bull case.

That’s because institutions are increasingly investing in spot bitcoin ETFs. ARK estimates that this could help bitcoin capture a 6.5% penetration of the total financial market in a best-case scenario.

Related: BlackRock Sees Growing Interest from Institutional Investors in Bitcoin ETFs

The second factor is bitcoin’s “digital-gold” narrative remaining a major driver in all scenarios. Puell notes that if adoption trends continue, bitcoin could capture up to 60% of gold’s $18 trillion market cap by 2030.

The third factor is the influence of macroeconomic instability, as bitcoin gains traction in regions where inflation and currency devaluation are major problems. Puell says:

“[Bitcoin’s] low barriers to entry provide individuals with internet connections in emerging markets access to an investment alternative.”

He added: “[Bitcoin helps] preserve purchasing power and avoid the devaluations of their own national currencies.”

The fourth factor is the emergence of bitcoin treasuries, as companies and countries are starting to add bitcoin to their balance sheets.

The spread of bitcoin adoption among nations—starting with El Salvador and Bhutan—is also boosting confidence.

President Donald Trump’s announcement of a Strategic Bitcoin Reserve in the U.S. has also boosted investor confidence.

The final factor is technical developments, with financial services utilizing the Bitcoin Lightning Network and Wrapped Bitcoin (WBTC) growing rapidly.

These services are projected to grow at up to 60% compounded annual growth rate (CAGR) by 2030, giving people even more ways to use and invest in bitcoin.

ARK’s model also takes into account bitcoin’s fixed supply which is expected to reach around 20.5 million by 2030. With such a limited supply and growing demand, ARK sees big price surges ahead.

If bitcoin hits the $2.4 million target, its market cap would be around $49.2 trillion, bigger than the combined GDP of the U.S. and China today. It would also put bitcoin ahead of gold as the largest asset globally.

Even the bear case is impressive. Reaching $500,000 would require a 32% CAGR, and the base case would need 53%.

Recent market behavior supports ARK’s view.

Bitcoin exchange balances have dropped sharply, and investors are moving their coins into private wallets rather than selling.

According to CryptoQuant data, exchange-held bitcoin fell from 3.4 million BTC in 2022 to 2.5 million BTC.