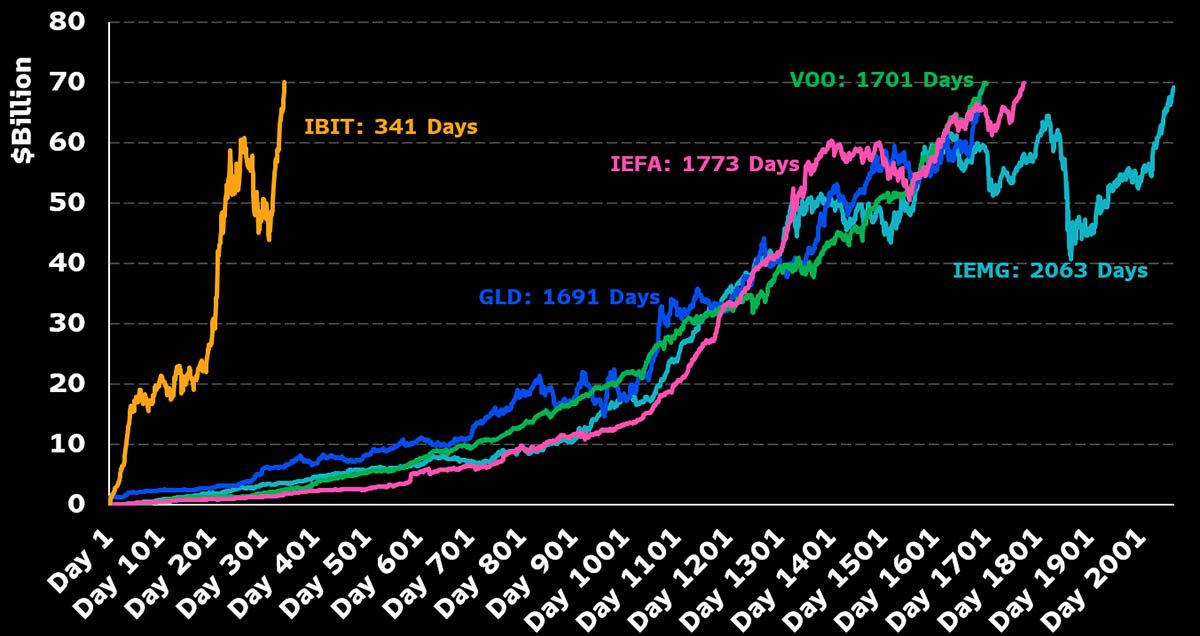

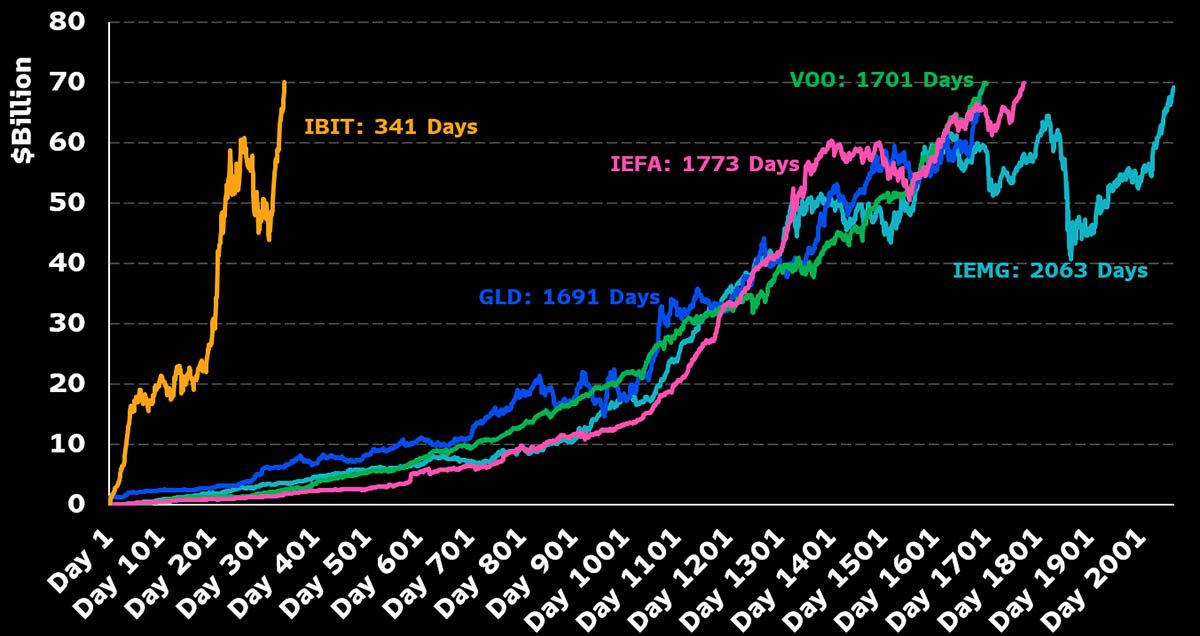

BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest exchange-traded fund (ETF) to ever reach $70 billion in assets under management (AUM).

The fund, which launched in January 2024, hit this milestone in just 341 trading days—five times faster than the previous record-holder, the SPDR Gold Shares ETF (GLD), which took 1,691 days to reach the same mark.

Bloomberg ETF analyst Eric Balchunas tweeted on June 9, “IBIT just blew through $70 billion and is now the fastest ETF to ever hit that mark in only 341 days.” This is a big deal and shows bitcoin is going mainstream.

The fund’s rapid growth means institutional investors are embracing bitcoin at scale.

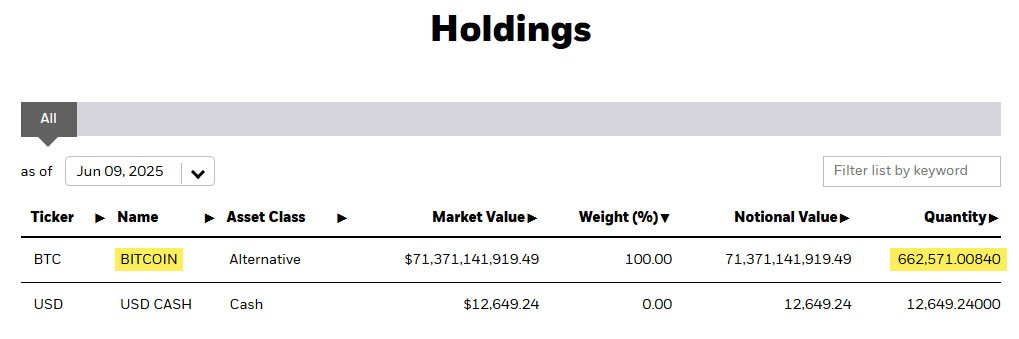

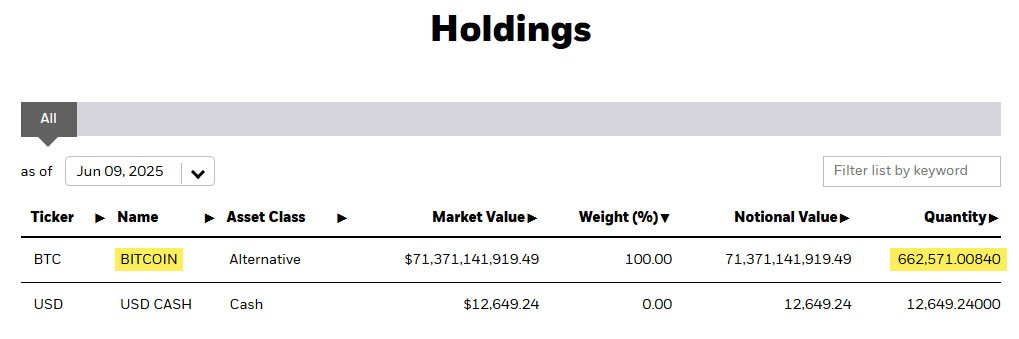

The fund has $71.9 billion in AUM and holds over 662,000 bitcoin. This makes BlackRock the largest institutional bitcoin holder in the world. To put that in perspective, the fund holds more bitcoin than Binance or Michael Saylor’s Strategy.

“IBIT’s growth is unprecedented,” said Bloomberg analyst James Seyffart. “It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class.”

BlackRock’s bitcoin ETF isn’t just big. It’s also greatly outperforming other spot bitcoin ETFs launched at the same time. BlackRock’s brand and global client base gave the fund instant credibility.

Many institutional investors want a regulated and convenient way to get into bitcoin without holding the asset directly, and this fund has made it easy for them to invest.

Robert Mitchnick, BlackRock’s head of digital assets, told Yahoo Finance that bitcoin’s rising status as an inflation hedge and alternative store of value is driving IBIT’s popularity.

He explained bitcoin is becoming an inflation hedge and alternative store of value and that’s what’s driving the growth.

Eric Balchunas also noted that when BlackRock filed for IBIT, bitcoin was at $30,000 and there was still skepticism after the FTX blowup. Now that bitcoin is at $110,000, it is “seen as legitimate for other big investors.”

Institutional demand for bitcoin has never been stronger, with IBIT making up nearly 20% of all bitcoin held by public companies, private firms, governments, exchanges and decentralized finance platforms.

That dominance may soon be challenged as public companies prepare to buy more bitcoin and shake up the current supply distribution.

Matthew Sigel, VanEck’s head of digital assets research, shared data that six public companies plan to raise, or have raised, up to $76 billion to buy bitcoin. That’s more than half of the spot Bitcoin ETF industry’s current AUM, so there’s clearly interest beyond ETFs.

On the broader market, IBIT’s rise coincided with bitcoin’s price surge to new highs above $110,000. The inflows reflect investors’ confidence in Bitcoin’s future and desire for regulated exposure through traditional products.

It’s worth mentioning that IBIT also had over $1 billion in volume on its first day of trading. It’s now the largest ETF in BlackRock’s lineup, even bigger than gold funds and other popular ETFs tracking international equities.