Blackstone, the world’s largest alternative asset manager, has entered the Bitcoin space with a $1.08 million investment in BlackRock’s Bitcoin ETF. This is a big deal for both Wall Street and the Bitcoin world.

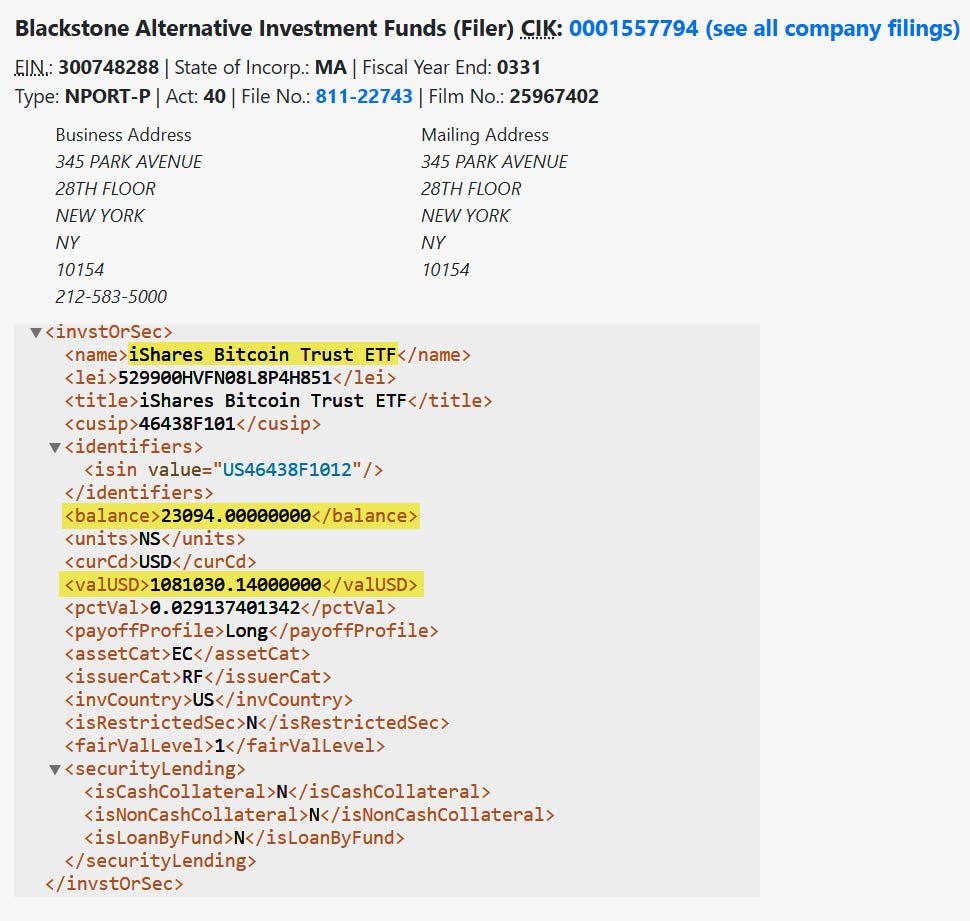

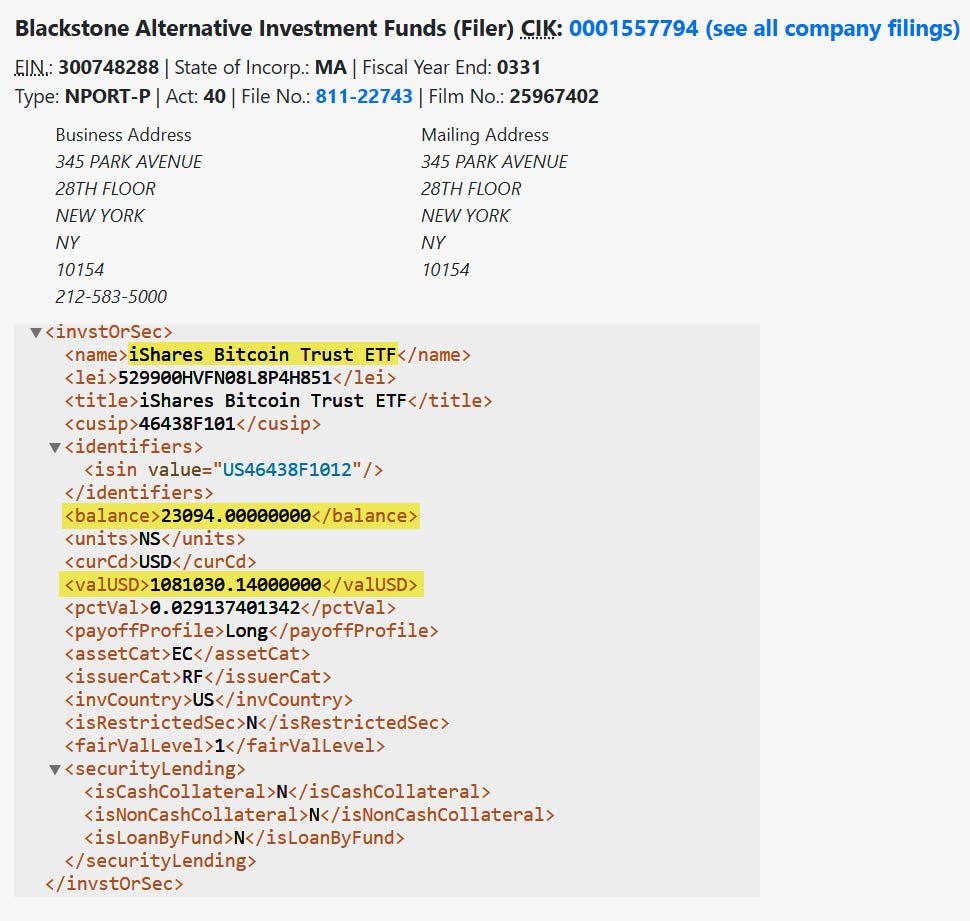

Blackstone has made its first direct investment in bitcoin through regulated financial products. A May 20, 2025, SEC filing revealed that the firm purchased 23,094 shares of the iShares Bitcoin Trust (IBIT), BlackRock’s spot Bitcoin exchange-traded fund (ETF).

While $1.08 million is a small drop in the bucket compared to Blackstone’s $1.2 trillion in assets under management, this is a big deal for the private equity giant which has been skeptical of bitcoin in the past.

In 2019, the company’s CEO, Steve Schwarzman, said he didn’t understand Bitcoin. “I was raised in a world where someone needs to control currencies,” he said, admitting he struggled to understand the technology.

Fast forward to 2025, and it is now one of the many institutional investors taking bitcoin seriously — but doing so through cautious, regulated channels.

The investment was made through Blackstone’s $2.63 billion Alternative Multi-Strategy Fund (BTMIX), which invests in a wide range of financial instruments.

Instead of buying bitcoin directly, Blackstone chose to get exposure through a bitcoin ETF — which is how many large institutions are approaching the digital asset. Spot Bitcoin ETFs like IBIT allow investors to track the price of bitcoin without having to hold the digital asset itself.

There are several advantages to this approach. ETFs trade like stocks, are regulated by the SEC and take care of complex issues like custody and compliance. This makes them more attractive for firms that are new to Bitcoin or still wary of the risks.

Related: Bitcoin ETFs Provide Convenient Price Exposure, But At What Cost?

Blackstone’s choice of a bitcoin ETF shows how effective these products are at connecting traditional finance to the digital age.

In addition to IBIT, Blackstone also disclosed smaller investments in two other digital-asset-related companies:

9,889 shares of the ProShares Bitcoin Strategy ETF (BITO), valued at about $181,166.

4,300 shares of Bitcoin Depot Inc. (BTM), a bitcoin ATM operator, worth approximately $6,300.

Together, these are a tiny fraction of Blackstone’s portfolio but show growing interest and exploration into the space.

Since its launch in January 2024, BlackRock’s IBIT ETF has become the top-performing Bitcoin ETF in the U.S. As of mid-May 2025, the fund has seen over $46.1 billion in net inflows with no outflows since early April.

IBIT is ahead of other major ETFs like Fidelity’s FBTC and ARK’s 21Shares Bitcoin ETF.

But the trend is clear: big firms are getting comfortable with regulated bitcoin products. Industry insiders see Blackstone’s move as part of a broader shift in institutional sentiment towards bitcoin.

This is a small investment but it matters because of who is making it. Blackstone is known for being conservative and risk-averse.

Its decision to put even a tiny amount of capital into Bitcoin ETFs means tradfi companies are getting more confident in bitcoin as an asset class. Blackstone is dipping its toe in the water, and even a small step is significant given its size and influence.