Meta Platforms Inc., the parent company of Facebook and Instagram, has voted down a shareholder proposal to add bitcoin to its treasury. The vote took place at the company’s annual shareholder meeting on May 30, 2025.

The proposal, known as Proposal 13, was submitted by investor Ethan Peck on behalf of the National Center for Public Policy Research (NCPPR).

It asked Meta to convert a portion of its $72 billion in cash, cash equivalents, and marketable securities into bitcoin. The idea was to hedge against inflation and low returns from traditional bond investments.

But the company’s shareholders said no.

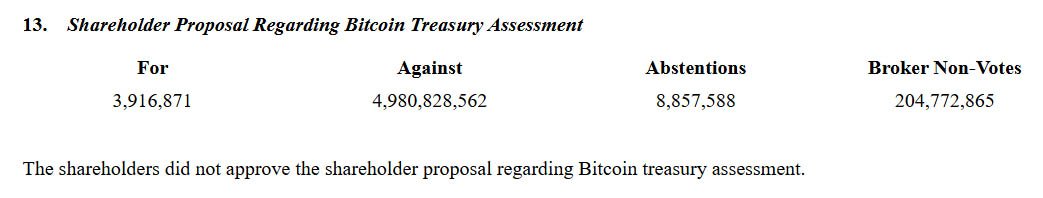

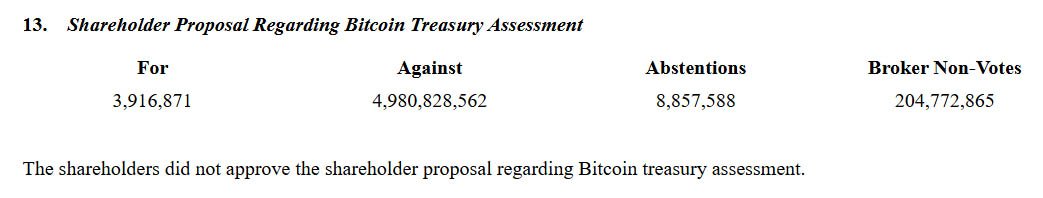

According to the official count, more than 4.98 billion shares were voted against the proposal, while 3.92 million shares were for it—less than 0.1% of total votes. 8.86 million shares were abstentions and over 204 million were broker non-votes.

So now, Meta joins Microsoft and Amazon in rejecting calls to add bitcoin to their balance sheets.

Related: Microsoft Shareholders Reject Bitcoin Investment Proposal

Proponents of the proposal argued that bitcoin would help protect Meta’s reserves from inflation and weak bond returns. Peck and others pointed to bitcoin’s strong performance in 2024 and growing institutional interest in the scarce digital asset.

The proposal said bitcoin’s fixed supply and track record make it a long-term store of value.

High-profile supporters, including Matt Cole, CEO of Strive Asset Management, brought the issue to the forefront. At the Bitcoin 2025 conference in Las Vegas, Cole addressed Meta CEO Mark Zuckerberg directly:

“You have already done step one. You have named your goat Bitcoin,” he said. “My ask is that you take step two and adopt a bold corporate bitcoin treasury strategy.”

Others, like Bloomberg ETF analyst Eric Balchunas, said if Meta added bitcoin to its balance sheet it would be a big deal. “If Meta or Microsoft adds BTC to the balance sheet, it will be like when Tom Hanks got COVID—suddenly, it feels real,” Balchunas said.

Despite all the hype and arguments for Bitcoin, the tech giant’s board of directors opposed the measure. The board said the company already has a treasury management process in place that prioritizes capital preservation and liquidity.

“While we are not opining on the merits of cryptocurrency investments compared to other assets, we believe the requested assessment is unnecessary given our existing processes to manage our corporate treasury,” Meta’s board noted.

The board also noted that it reviews many investment options and sees no need for a separate review process specific to Bitcoin.

Meta’s decision shows the broader hesitation of large-cap companies to get into bitcoin as part of their financial strategy.

While companies like Michael Saylor’s Strategy are adding bitcoin to their treasuries every chance they get, companies like Microsoft, Amazon and now Meta, are taking a more cautious approach.

According to recent reports, Meta is exploring ways to integrate stablecoins into its platforms to enable global payouts.

This would be a re-entry into the digital asset space after the company shelved its Diem project due to regulatory issues—a step that bitcoin advocates deem unnecessary, insufficient, and irrelevant to protecting the company’s finances.